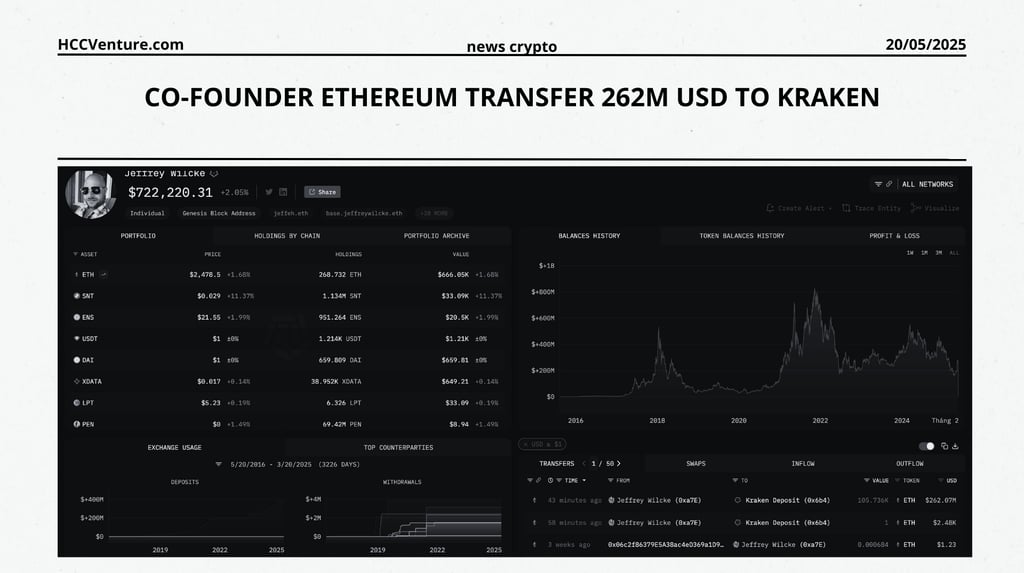

Ethereum Co-Founder Transfers Over $261 Million ETH to Kraken Exchange

According to on-chain data from Arkham and Etherscan, Jeffrey Wilcke, one of the co-founders of Ethereum, just made a large transaction when he transferred about 105,735 ETH, worth $261,260,267.83, to the Kraken exchange.

5/20/20253 min read

Context and action analysis

Jeffrey Wilcke is one of the co-founders of Ethereum, having played a key role in the project's early years. The wallet 0xa7E4fEcd... has been confirmed to belong to him by multiple on-chain tracking platforms, including Arkham.

The move of more than $261 million ETH to Kraken attracted a lot of attention in the crypto community because:

This is one of the largest private ETH transactions since early 2025.

Signs of a possible sell-off or asset reallocation , especially as the ETH market is trading around $2,470/ETH (according to trading time data).

The Ethereum founder's move of a large amount of ETH to the exchange is often interpreted by the community in two ways:

Negative: Could be a selling signal, putting downward pressure on prices in the short term.

Positive/Neutral: Can serve personal financial, investment or donation purposes, not necessarily immediate sale.

It should be noted that Wilcke also made large-scale transactions in 2023 and 2024, but they did not immediately have a strong impact on ETH prices.

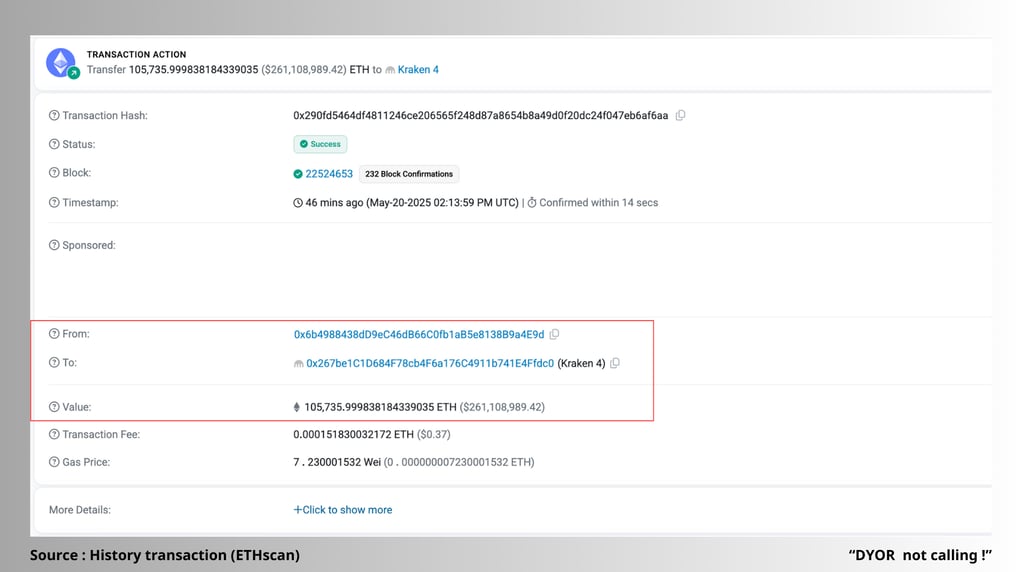

Transaction details

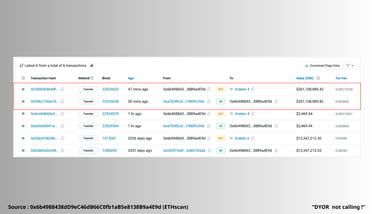

Sending wallet: 0xa7E4fEcdDc20d83F36971b67E13f1abC98DFcfA6

Intermediate wallet (first recipient): 0x6b4988438dD9eC46dB66C0fb1aB5e8138B9a4E9d

Destination wallet (Kraken hot wallet): 0x267be1C1D684F78cb4F6a176C4911b741E4Ffdc0

Time: Transaction confirmed at 13:13 UTC on 20/05/2025

ETH Amount: 105,735,999 ETH

Transaction Fee: 0.00015183 ETH (~0.37 USD)

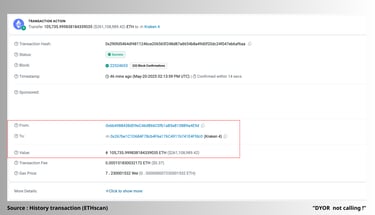

This major transaction took place in two distinct steps:

Jeffrey Wilcke transfers ETH from personal wallet to intermediary wallet (0x6b4988...4E9d)

The intermediary wallet then transfers all the ETH to Kraken's hot wallet (0x267be1...Ffdc0)

Jeffrey Wilcke's Behavior In Large-Scale ETH Trading

Instead of transferring ETH directly from his personal wallet to the Kraken wallet, Jeffrey Wilcke chose to send ETH to an intermediary wallet before pushing it all to the exchange. This is a common trading pattern in behavior:

Risk diversification : Separating long-term storage wallets and transaction wallets helps reduce security risks.

Reduce immediate attention : Moving through an intermediary wallet can be a way to delay tracing or confuse automated alert systems.

Prepare for strategic large-lot trades : Not sending directly to the exchange may be a sign that ETH sales (if any) will be made in small allocations over time , to avoid causing sharp price fluctuations.

The trade was made when ETH was trading around $2,470 , after a recovery from the $2,200 region in just 10 days. This leads to the hypothesis:

Wilcke may be taking some profits after years of holding ETH (many of which were accumulated since the Genesis Block).

If true, this reflects a very strategic market mindset : taking advantage of high price zones, taking controlled profits instead of panic selling.

Wilcke moved over 105,000 ETH in a single transaction , without splitting the order. This shows:

Confident in market liquidity , especially Kraken liquidity – where he deposited his assets.

Maybe he doesn't intend to sell all of this ETH right away, but simply transfer it to the exchange to serve purposes such as staking, funding, or securing finances for personal projects.

It's not the first time Wilcke has made a large-scale transaction. In previous years:

In 2020, he transferred 92,000 ETH to Kraken exchange.

That transaction did not have a noticeable negative impact on the price of ETH, as most of the ETH was distributed slowly or not sold immediately.

If this pattern repeats, the market may be overly nervous in the short term but it does not necessarily lead to real selling pressure.

Once again we give our opinion on potential projects in the crypto market. This is not investment advice, consider your portfolio. Disclaimer: The views expressed in this article are solely those of the author and do not represent the platform in any way. This article is not intended to be a guide to making investment decisions.

Compiled and analyzed by HCCVenture

Join our telegram community: HCCVenture

Explore HCCVenture group

HCCVenture © 2023. All rights reserved.

Connect with us

Popular content

Contact to us

E-mail : sp_contact@hccventure.com

Register : https://linktr.ee/holdcoincventure

Disclaimer: The information on this website is for informational purposes only and should not be considered investment advice. We are not responsible for any risks or losses arising from investment decisions based on the content here.

TERMS AND CONDITIONS • CUSTOMER PROTECTION POLICY

ANALYTICAL AND NEWS CONTENT IS COMPILED AND PROVIDED BY EXPERTS IN THE FIELD OF DIGITAL FINANCE AND BLOCKCHAIN BELONGING TO HCCVENTURE ORGANIZATION, INCLUDING OWNERSHIP OF THE CONTENT.

RESPONSIBLE FOR MANAGING ALL CONTENT AND ANALYSIS: HCCVENTURE FOUNDER - TRUONG MINH HUY

Read warnings about scams and phishing emails — REPORT A PROBLEM WITH OUR SITE.